The penalty for filing Forms W2 or W3 after August 1 is $260 per turn. The maximum annual fee for a small business that fails to file these forms is $187,500 or $536,000, depending on the rate. Businesses that fail to remit the taxes they withhold from their employee's wages to the IRS can face civil penalties. 2.. IRS civil penalties are fees issued because of civil offenses, like failing to file your tax return on time or failing to pay the tax you owe. Six common civil penalties include: Penalty for underpayment of estimated tax. Failure to file/late filing penalty. Failure to pay/late payment penalty. Accuracy-related penalty.

More Big Money OSHA and EPA Civil Penalties Increase for 2023 Workplace Safety and

Civil Penalty Amounts Increase

PPT THE NOAA CIVIL PENALTY PROCESS From Receipt Of File Through Closing Of Case PowerPoint

OSHA Civil Penalties On the Rise Again The OSHA Defense Report

Civil penalty and gavel with document. Law concept Stock Photo Alamy

![Civil Penalty Amounts for 2021 Increased by DOL [VIDEO] » Civil Penalty Amounts for 2021 Increased by DOL [VIDEO] »](https://mytpg.com/wp-content/uploads/2021/01/DOL-Increases-Civil-Penalty-Amounts-for-2021-1.18.21-Featured.jpg)

Civil Penalty Amounts for 2021 Increased by DOL [VIDEO] »

Civil Penalty Notice for Employing Illegal Workers A Y & J Solicitors

Civil Penalties Amendments for 2019 Hazmat University

CPSC Civil Penalties and Small Businesses The Giggle Guide® Business Sense

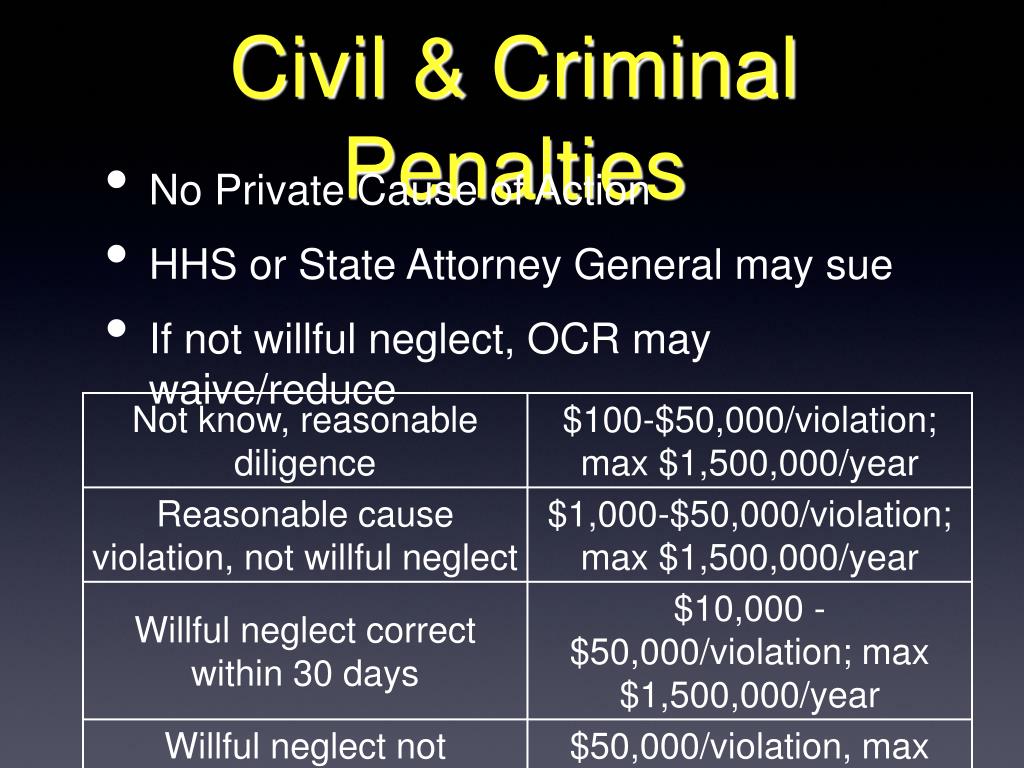

PPT Adam S. Levine , M.D., J.D. PowerPoint Presentation, free download ID4169046

Civil penalty orders imposed on SMSF trustees Leading SMSF Law Firm

IRS Civil Penalty Help with Back Taxes Penalties

Civil Penalties Free of Charge Creative Commons Legal 1 image

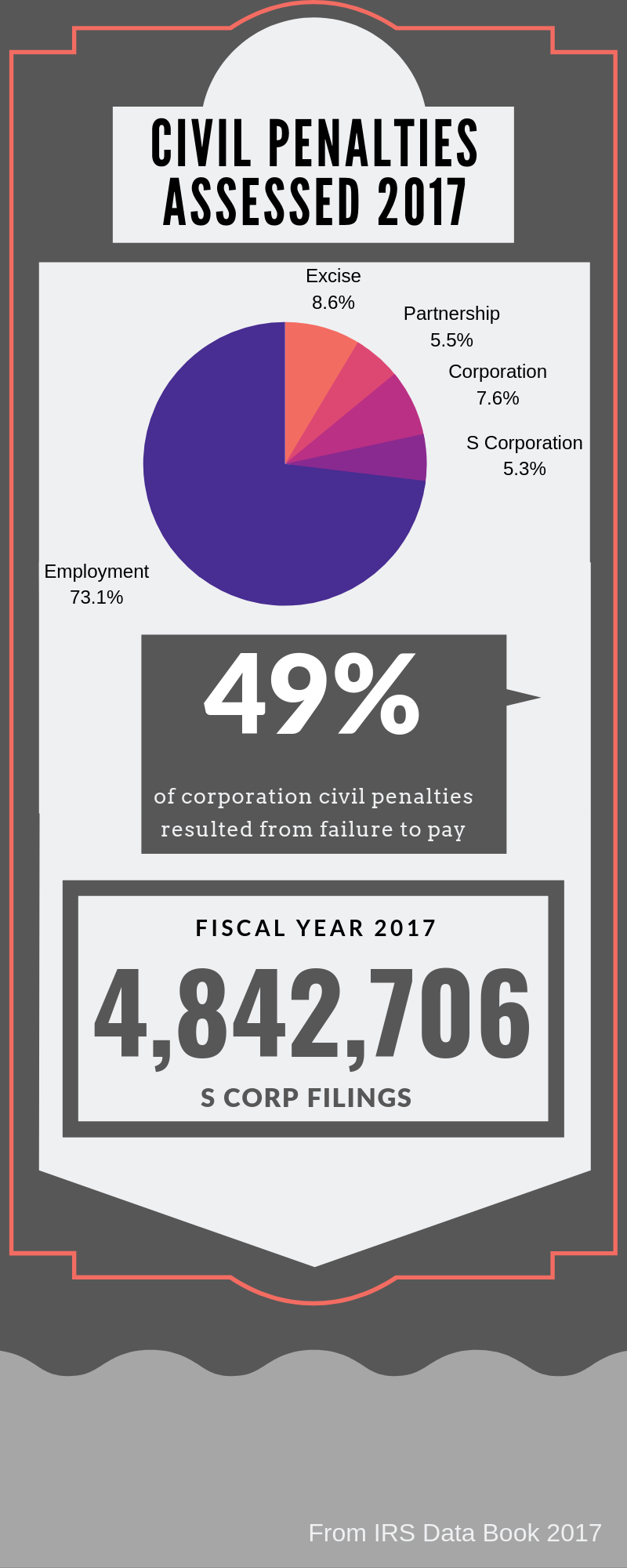

Civil Penalties 2017 Jack Trent & CO

PPT ENVIRONMENTAL CIVIL PENALTIES PowerPoint Presentation, free download ID333113

PPT ENVIRONMENTAL CIVIL PENALTIES PowerPoint Presentation, free download ID333113

The Law Provides For A Civil Penalty For An Intentional Violation By A Riset

PPT Choose Your Civil Penalty PowerPoint Presentation, free download ID522930

Commission Denies Joint Petition for Rescission of Civil Penalty, ITC Blog Insights Jones Day

PPT M S H A PowerPoint Presentation, free download ID1292820

Civil money penalties and payments to harmed consumers from the Civil Penalty Fund are different. When a company or person that violated the law is ordered to pay a civil penalty, that penalty does not go directly to that company's or person's victims, but rather is put in the Civil Penalty Fund.. penalty. A penalty is the punishment imposed upon a person who has violated the law, whether or a contract, a rule, or regulation. A penalty can be in response to either civil or criminal violations, though civil penalties are usually less severe. Some penalties require only the payment of some amount of money that is determined either by.