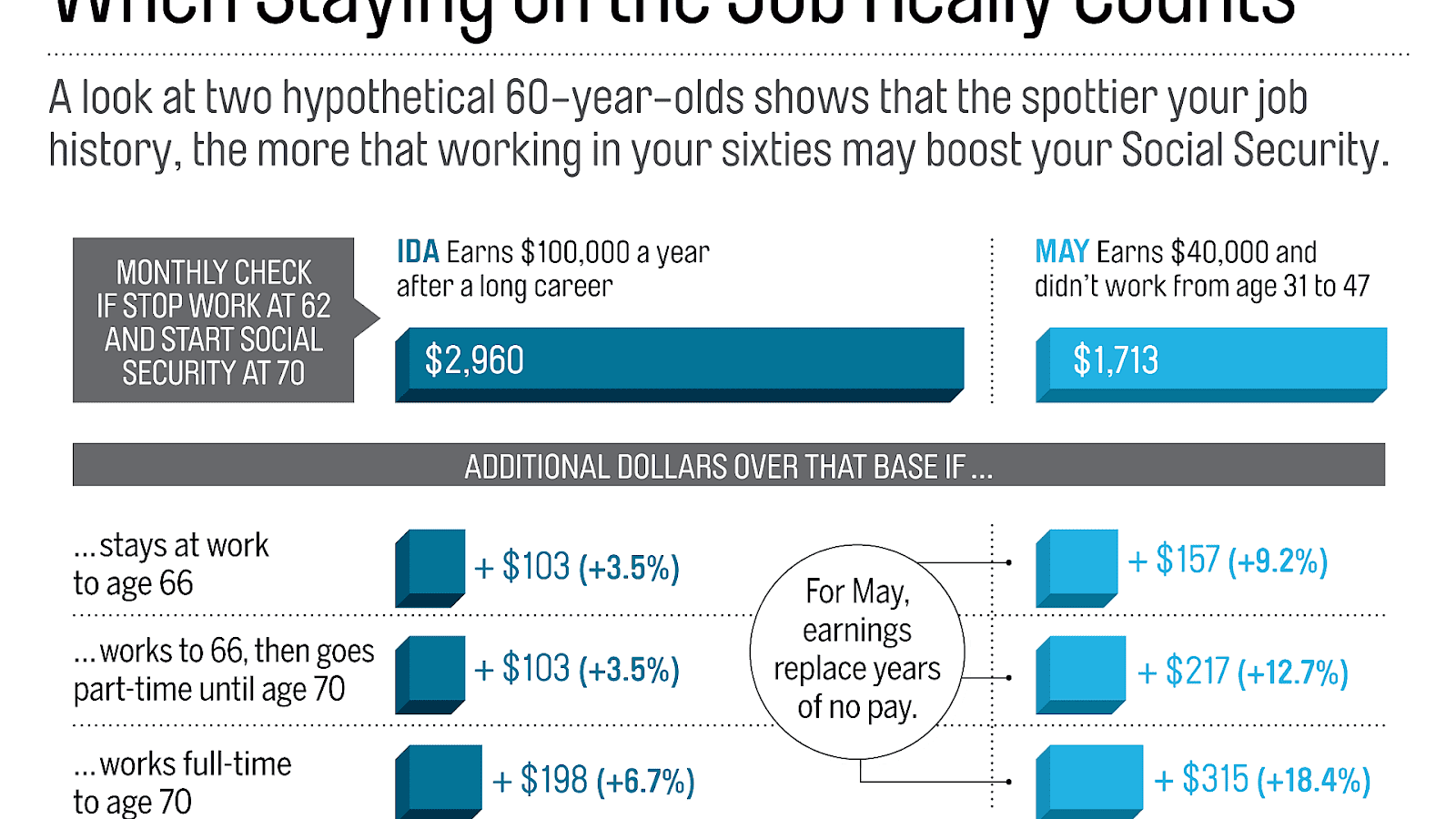

Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes. If.. You're married filing a joint return, both of you are older than 65, and your combined gross income was at least $27,800. You're married filing separately, and your gross income was $5. You're a qualifying widow, and you earned at least $26,450. For tax-filing purposes, you're considered age 65 if you turn 65 at the end of your tax year.

Your Ultimate Guide to Australian Working Holiday Taxes

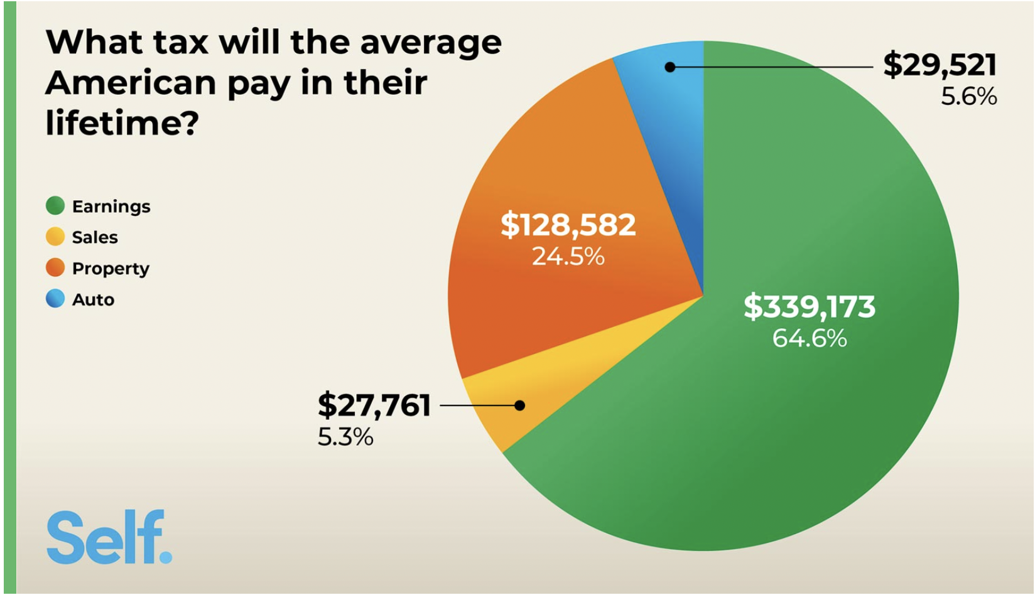

Think you’ll stop paying tax when you retire? Think again.In fact, the average tax bill for

Michiganders pay 20thhighest lifetime taxes nationwide, data says Michigan

![How much tax do I pay in Australia? Rask Finance [HD] YouTube How much tax do I pay in Australia? Rask Finance [HD] YouTube](https://i.ytimg.com/vi/V_au7AfCjKw/maxresdefault.jpg)

How much tax do I pay in Australia? Rask Finance [HD] YouTube

Tax Australia Effective Reduction Strategies Explained Loopholes Your Accountant May Use In

When are Payroll Taxes Due? Know Your Australian Tax Deadlines

What Age Do You Have To Start Paying Taxes Start Choices

Australian Payg Tax Table Elcho Table

5 ways to pay less taxes legally as an international student in Australia YouTube

What Age Do You Stop Paying Taxes on Social Security? Benefits Explained

A quick guide to taxes in Australia Australia Property Guides

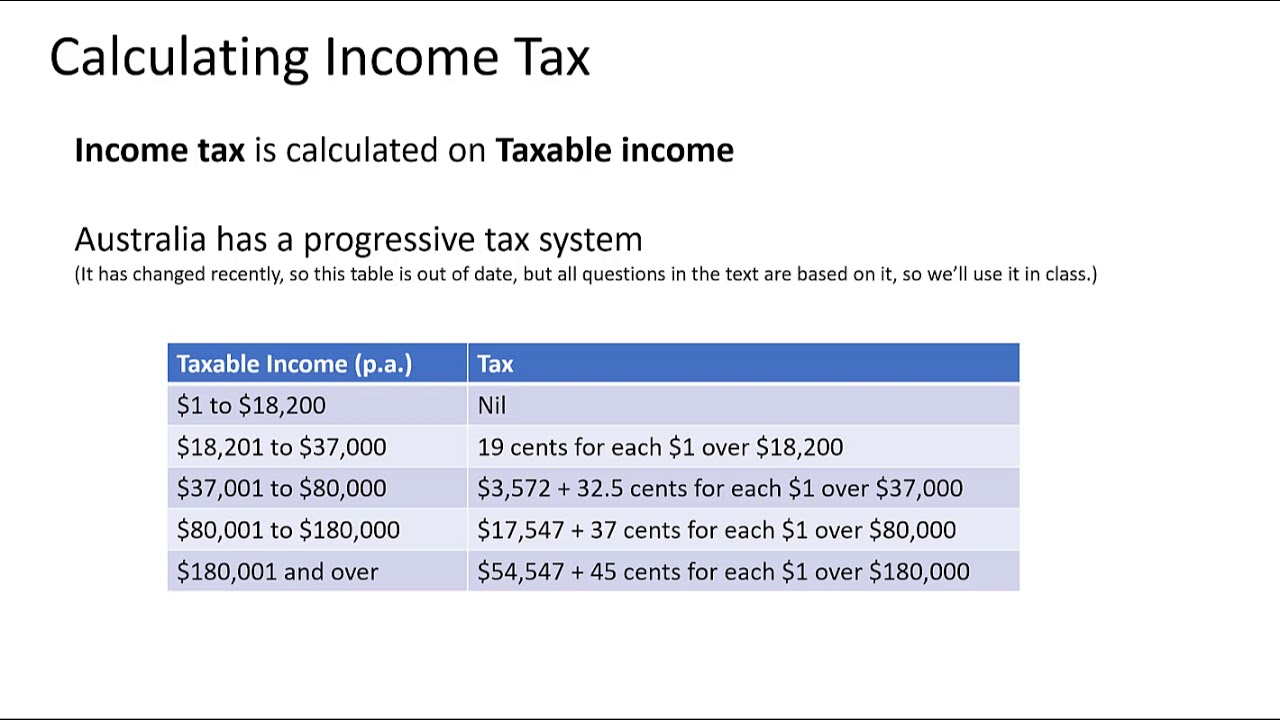

Tax In Australia What Are Tax Brackets And Rates?

How Australians Can Pay ZERO Taxes Legally? Australian Real Estate Property Investing

Chart How Much Tax Do Undocumented Immigrants Pay? Statista

Here’s everything you need to know about Australian taxes This is Australia

Do I Need To Pay Taxes On Bitcoin Gains Tax Walls

At a glance Treasury.gov.au

At what age do you stop paying property taxes in AZ? YouTube

Starting your research tools Australian Taxation Law Library Guides at University of Melbourne

7 MindBlowing Ways the RICH Reduce TAXES in Australia 😱 YouTube

Tax on Super Withdrawals Over 60. In most cases, you will be able to withdraw your super tax free as either a lump sum, or income stream if you are over 60 - whether your super is in accumulation phase or pension phase. This is where most people can get confused. Because, while withdrawals from super are tax-free once you reach age 60, it.. The best time to retire for tax purposes in Australia is generally once you attain age 60, as it is at this stage that you will have tax-free access to your superannuation. The best time of the year to retire for tax purposes in Australia is once you have earned around $18,200 worth of taxable income for the year, because this is currently the.