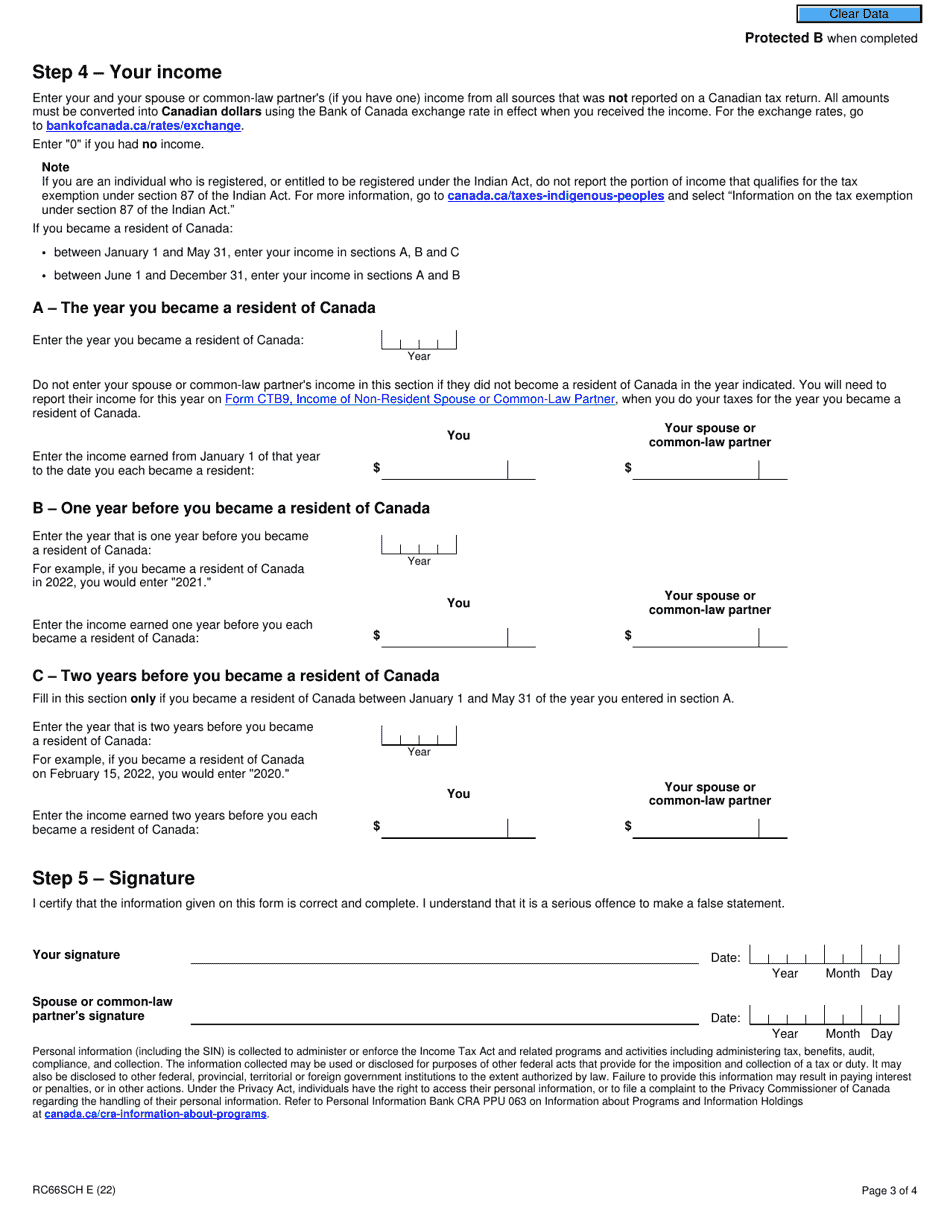

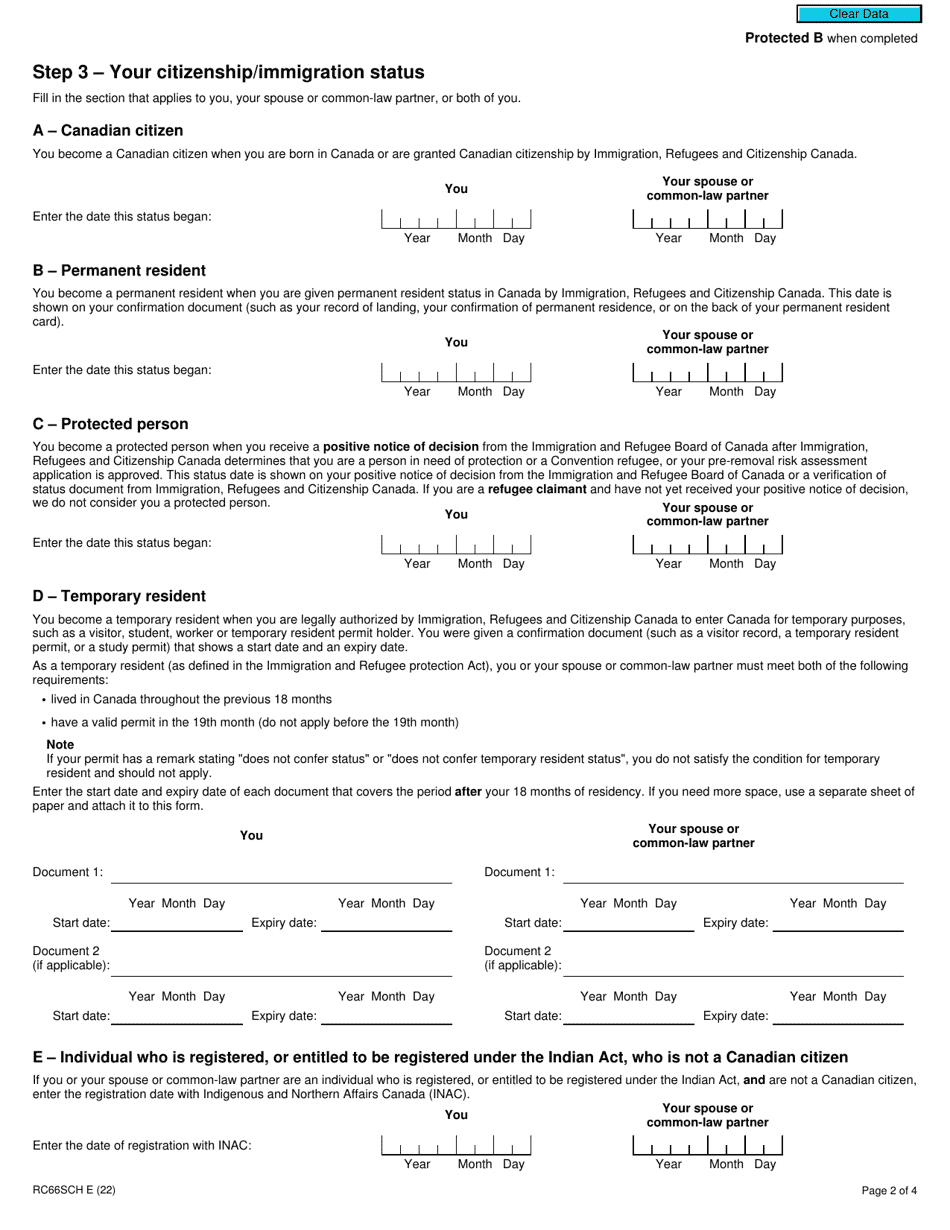

Schedule RC66SCH, Status in Canada/Statement of Income. Send us your Form RC66 along with any required schedules and documentation as soon as possible after you and your child arrive in Canada. In addition to the CCB, you can also receive a CDB if your child meets the criteria for the disability amount and we approved. Status in Canada / Statement of Income when completed Complete this schedule, and attach it to your Form RC66, Canada Child Benefits Application, if you or your spouse or common-law partner: • became a new resident or returned as a resident of Canada in the last two years; • became a Canadian citizen in the last 12 months; or

![[The following information applies to the questions displayed below.] The beginning account [The following information applies to the questions displayed below.] The beginning account](https://media.cheggcdn.com/media/1a0/1a0626fb-eacd-40f8-aded-aab589f8a5ad/1583057173269_NewDoc2020-03-0115.34.50.png)

[The following information applies to the questions displayed below.] The beginning account

Form RC66SCH Download Fillable PDF or Fill Online Status in Canada and Information for

What is included in the Statement? Statement Items Part1 YouTube

Pin on Awesome Accountants

the printable form for an employee's statement is shown in black and white

Child Tax Benefit Application Form Rc66sch CVACLAN

Sample Statement format Elegant Sample In E Statement 11 Examples In Excel Pdf

新移民到加拿大后如何报税 知乎

2011 Form Canada RC66 E Fill Online, Printable, Fillable, Blank pdfFiller

statement Example Edit, Fill, Sign Online Handypdf

Generating a Pro Forma Statement Generator For Homeowners Pro forma statement

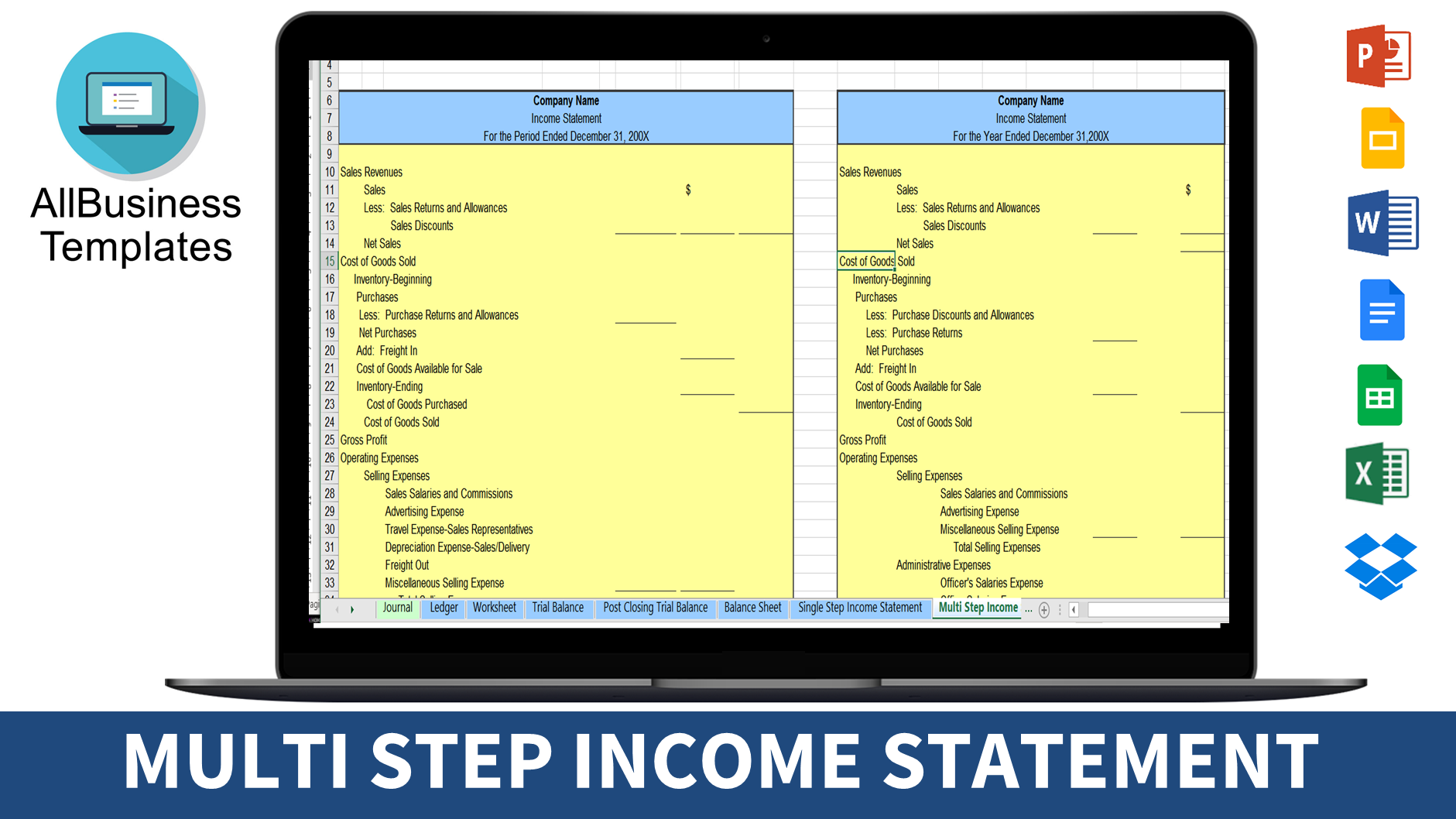

免费 Multi Step Statement External Reporting 样本文件在

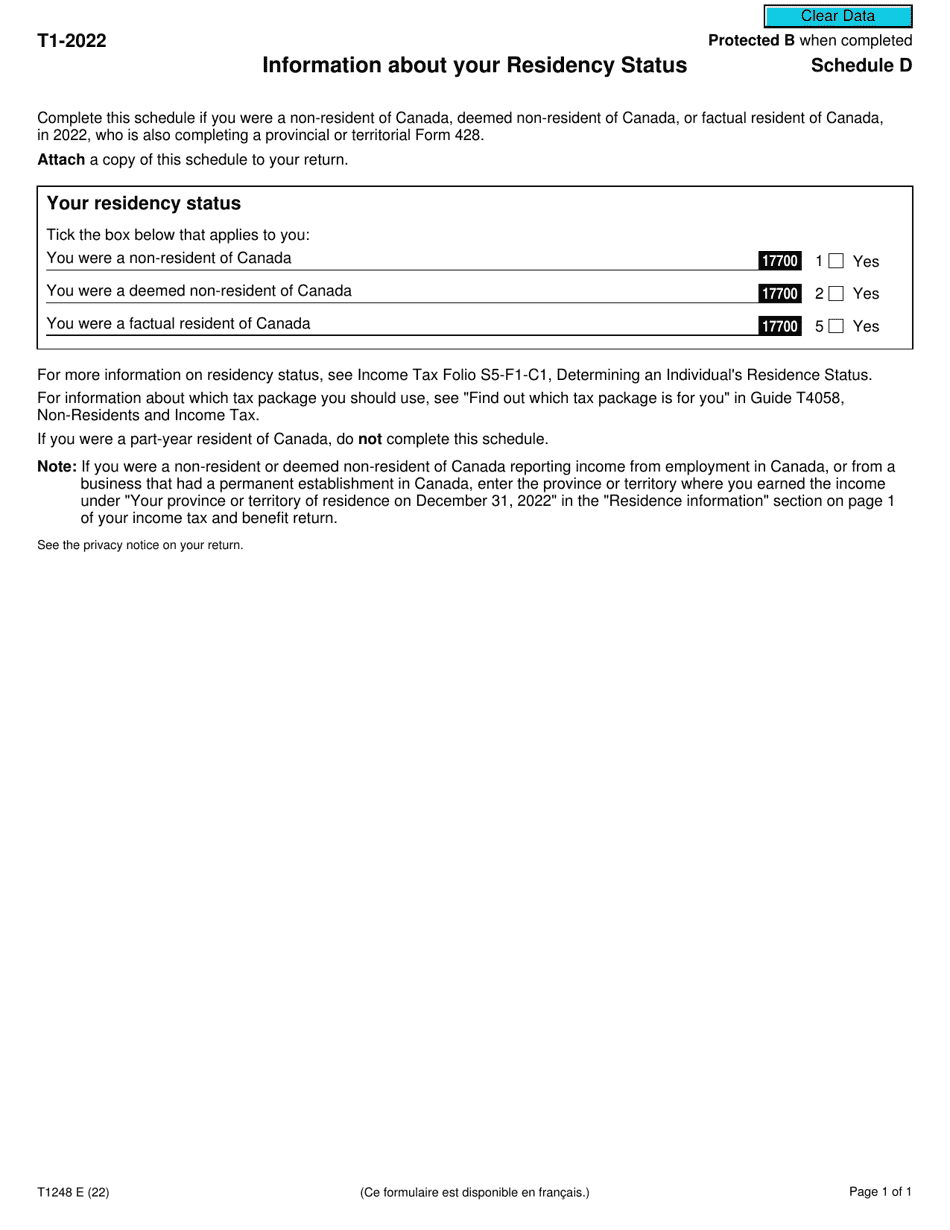

Form T1248 Schedule D Download Fillable PDF or Fill Online Information About Your Residency

Trivia Which financial statement displays the revenues and expenses of a company for a period

2017 Form Canada RC66 E Fill Online, Printable, Fillable, Blank pdfFiller

Statements Explained Definition and Examples Pareto Labs

Introduction to Statement TaxHelp.ae

Form RC66SCH Download Fillable PDF or Fill Online Status in Canada and Information for

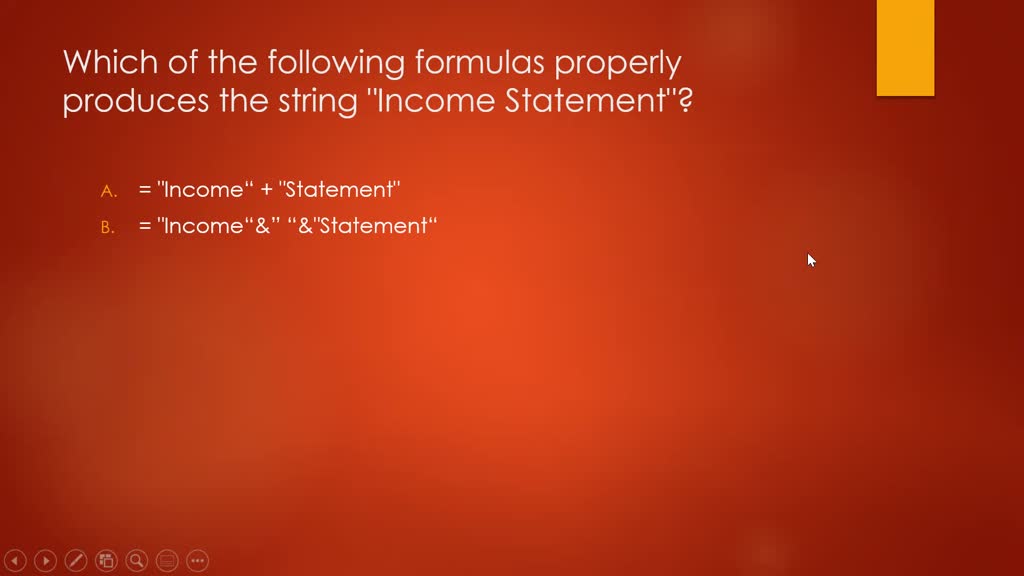

SOLVED Which of the following formulas properly produces the string Statement"?

Form RC66SCH Fill Out, Sign Online and Download Fillable PDF, Canada Templateroller

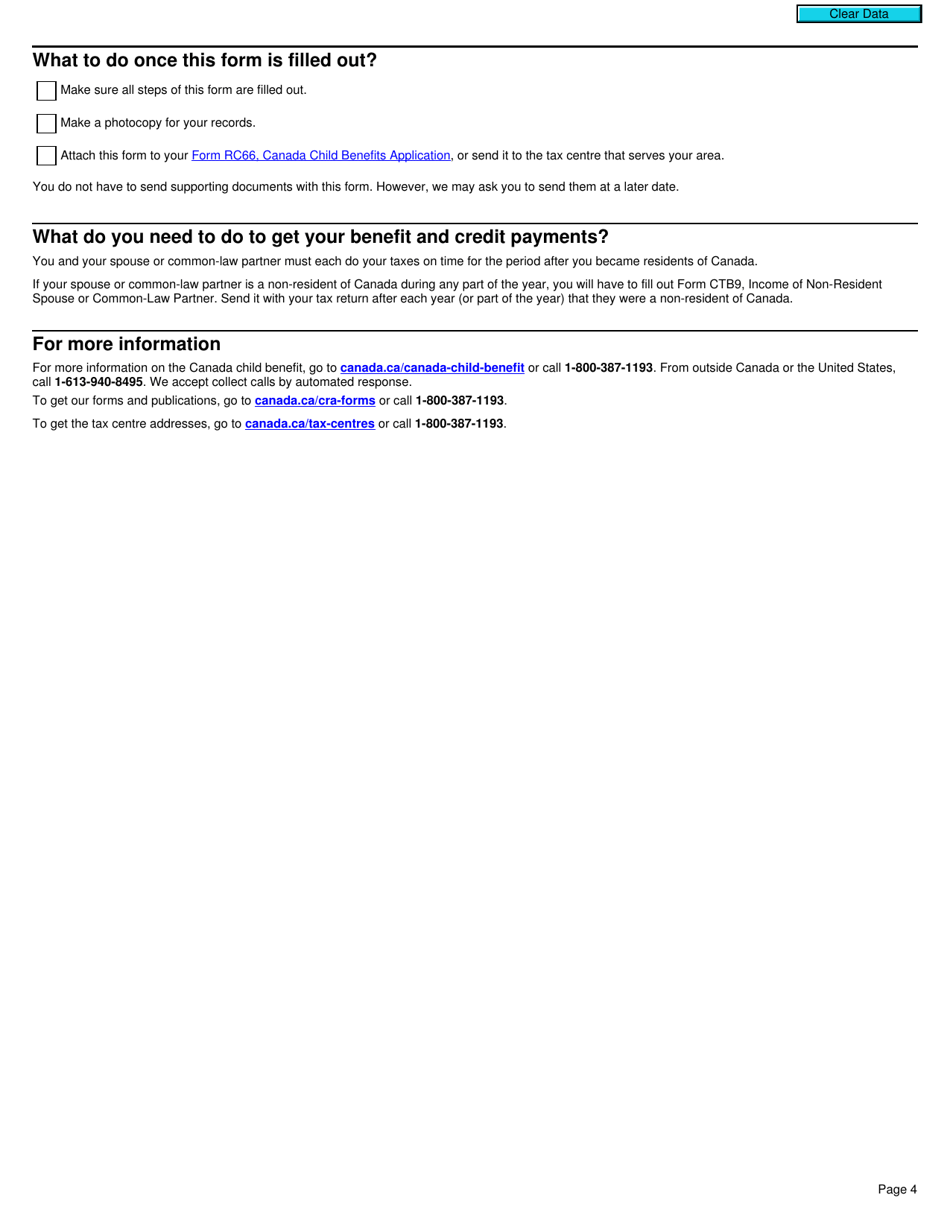

3. You must be a resident of Canada for tax purposes. We consider you to be a resident of Canada when you establish sufficient residential ties in Canada. For more information, see Income Tax Folio S5-F1-C1, Determining an Individual's Residence Status. 4. You or your spouse or common-law partner must be any of the following: a Canadian citizen. We want to process your Form RC66, Canada Child Benefits Application, as soon as we can. Be sure to do the following: Checklist Complete schedule RC66SCH, Status in Canada/Statement of Income, if it applies to you or to your spouse or common-law partner and attach it with your application. Sign and date the application form.